Cybersecurity for Financial Services

Securing a financial organization can seem like a daunting task — especially as industry IT leaders juggle so many different priorities. The Blumira SIEM + XDR is easy to set up and easy to use for cybersecurity detection, response, and compliance.

Cybersecurity Challenges for Financial Services

The financial services sector is highly regulated by frameworks including PCI DSS, FFIEC, and NYDFS.

Financial services experience the highest volume of security incidents and have the highest annual cost of cybercrime – averaging $18.28 million for U.S. companies, according to Accenture.

A data breach can tarnish a brand’s image and diminish customer confidence.

A Traditional SIEM is Not Enough

While many financial institutions use traditional security information and event management (SIEM) platforms to detect cybersecurity threats, IT teams may not have the expertise to understand a threat’s severity and take appropriate next steps once they’re notified of an event.

A traditional SIEM requires regular optimization to defend against the latest cyber-attacks. In large corporations, a 24/7 security operations center (SOC) staffed by specialized IT security analysts sifts through alerts, determines their severity, takes action, and maintains the system on an ongoing basis. A SOC demands a skill set and resources that not every financial institution has available to them.

Blumira Addresses the Financial Services Security Gap

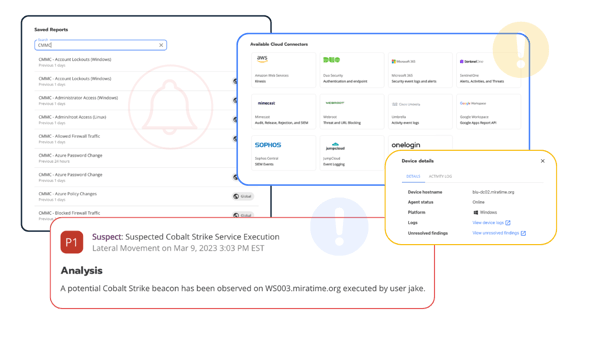

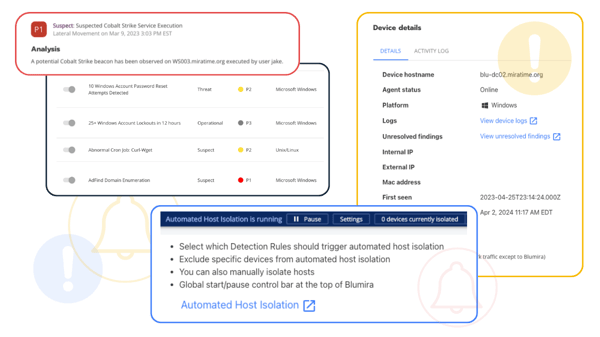

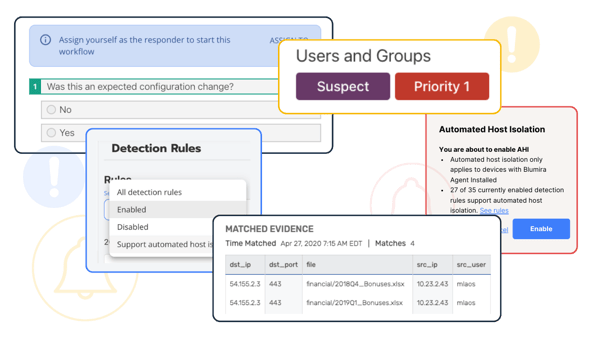

Blumira provides an advanced threat detection and response platform that alerts your team about critical cyber threats in real time. Blumira also brings automated and actionable response capabilities that reduce the overhead associated with traditional SIEM products.

Blumira does the background work for your team so it’s easy to implement and intuitive to use, allowing existing teams to get it up and running in a few hours. Blumira helps you meet compliance mandates painlessly.

Adopt a more effective approach to cybersecurity in financial services and get your free account today.

Cybersecurity Best Practices for Financial Institutions

There are some best practices that IT teams in finance can follow, even with limited budgets and staff.

-

Prioritize End User Training

Prioritize end user training

IT and security teams should know about ransomware warning signs, but so should end users. Failure to train and educate users often points to a broader issue — a lack of security culture. That, combined with the fact that human error is the starting point for many cyberattacks, means that organizations should make training a higher priority.

At a minimum, IT and security teams should inform staff about how to spot a phishing email. More formal security awareness training is even better, but an informal chat about what a phishing email can look like and what to do is a good first step.

-

Deploy Sysmon

Deploy Sysmon

When it comes to preventing ransomware, it’s important to have visibility into an environment. Endpoint detection and response (EDR) tools can achieve that, but they can also be prohibitively expensive for local banks and credit unions with limited budgets. System Monitor (Sysmon for short) is a free Microsoft utility that small IT teams can use to get visibility into their environments. Sysmon is part of the Sysinternals software package and provides a higher level of event monitoring than the standard Windows logs. It records events such as network connections, process creations, file hashes, and changes to the Windows Registry.

IT leaders without the budget for an EDR solution should deploy Sysmon for enhanced logging that can provide a wealth of data about endpoints. Since Sysmon is free, it does require more care and feeding than a plug-and-play paid tool. IT admins need to deploy updates as they are released and make configuration changes as necessary, but those tasks generally fall under the umbrella of standard patch management. It’s relatively easy to install and configure Sysmon in a few steps.

-

Implement Threat Detection and Response

Implement threat detection and response

Using Sysmon and a centralized log management tool will provide some visibility into an environment and help with alerting, but small IT and security teams need to know how to respond to those alerts. A threat detection and response solution alerts IT and security teams about suspicious behavior that indicates ransomware attack.

Prioritize end user training

IT and security teams should know about ransomware warning signs, but so should end users. Failure to train and educate users often points to a broader issue — a lack of security culture. That, combined with the fact that human error is the starting point for many cyberattacks, means that organizations should make training a higher priority.

At a minimum, IT and security teams should inform staff about how to spot a phishing email. More formal security awareness training is even better, but an informal chat about what a phishing email can look like and what to do is a good first step.

Deploy Sysmon

When it comes to preventing ransomware, it’s important to have visibility into an environment. Endpoint detection and response (EDR) tools can achieve that, but they can also be prohibitively expensive for local banks and credit unions with limited budgets. System Monitor (Sysmon for short) is a free Microsoft utility that small IT teams can use to get visibility into their environments. Sysmon is part of the Sysinternals software package and provides a higher level of event monitoring than the standard Windows logs. It records events such as network connections, process creations, file hashes, and changes to the Windows Registry.

IT leaders without the budget for an EDR solution should deploy Sysmon for enhanced logging that can provide a wealth of data about endpoints. Since Sysmon is free, it does require more care and feeding than a plug-and-play paid tool. IT admins need to deploy updates as they are released and make configuration changes as necessary, but those tasks generally fall under the umbrella of standard patch management. It’s relatively easy to install and configure Sysmon in a few steps.

Implement threat detection and response

Using Sysmon and a centralized log management tool will provide some visibility into an environment and help with alerting, but small IT and security teams need to know how to respond to those alerts. A threat detection and response solution alerts IT and security teams about suspicious behavior that indicates ransomware attack.

Cybersecurity Made Easy for Financial Organizations

Six ways Blumira provides value to banks, credit unions, insurance firms, and other financial institutions

Check Out Even More Resources

See MoreCredit Unions and Cybersecurity: Protecting Members in the Digital Age

Read More

18 Must-Haves: Security Checklist for Credit Unions

Read MoreOn Demand - How Updated CIS Controls Help Safeguard Public Utilities and Government Agencies

Read MoreGet Started for Free

Experience the Blumira Free SIEM, with automated detection and response plus compliance reports for 3 cloud connectors.